FREE Best Weekly Budget Planner: Budgeting Busy Mums 2024

Managing a household’s finances can be daunting in today’s fast-paced world. This is especially true for busy mums like me who strive to juggle everything. I’ve compiled the best weekly budget planner to help me manage everything. Budgeting is the cornerstone of financial stability for mums, acting as the guiding light through the complexities of economic decision-making.

It’s not merely about tracking expenses or saving a portion of your income. It’s about crafting a vision for your family’s future and taking deliberate steps towards realising that dream.

For mums, mastering the art of budgeting means ensuring every penny spent or saved serves a purpose. Which aligns with the family’s broader goals and aspirations. It empowers you to make informed choices, prevent financial stress, and confidently satisfy your family’s needs and wants.

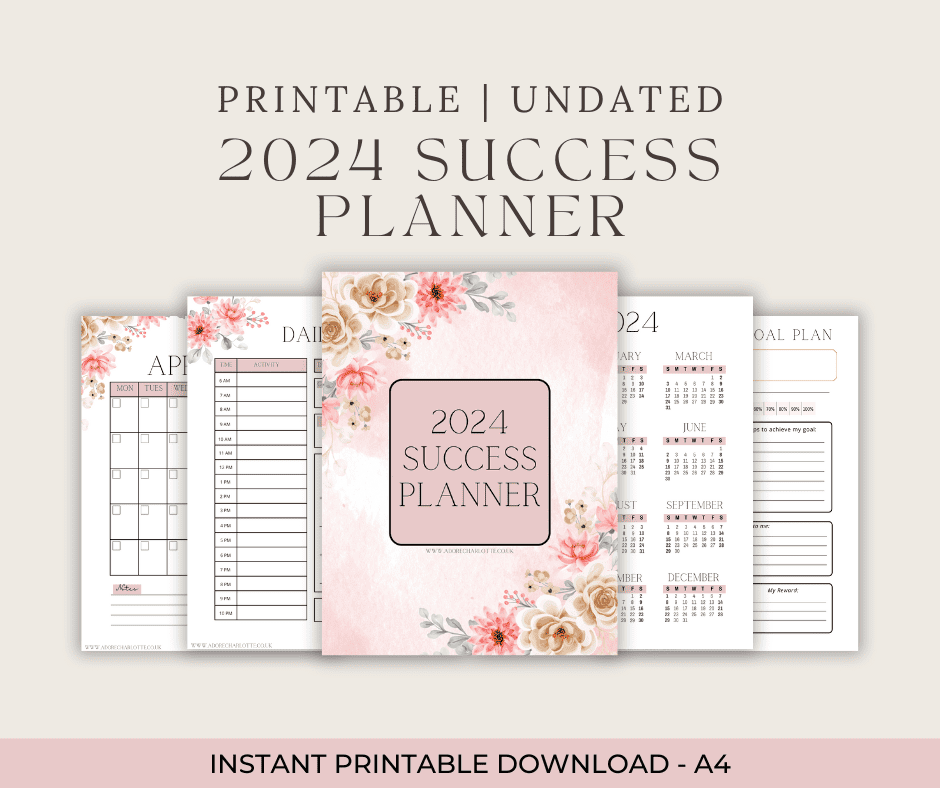

Free Download Success Planner

My FREE best weekly budget planner for Budgeting Busy Mums is a game-changer. It offers 49 meticulously designed pages to help you achieve your financial goals quickly and gracefully. From weekly and monthly planning pages to habit trackers and daily gratitude sections, this planner is more than just financial aid—it’s a roadmap to a more organised and financially secure life.

The Importance of Budgeting for Mums and Families

In the heart of every family, mums play a pivotal role in steering the household’s financial ship through calm and stormy seas. Budgeting, far from being just a routine task, is a powerful tool in a mum’s arsenal. It enables you to safeguard your family’s financial well-being and carve out a future filled with promise and security.

Building a Financial Foundation

Budgeting establishes a stable financial future’s foundation. It involves understanding your money’s destination, prioritising expenditures, and meeting your needs without sacrificing future savings. For families, this translates into peace of mind from being able to pay bills, have assurance of groceries, and steadily grow savings.

Steering Towards Financial Goals

Budgeting can make all these dreams attainable, whether saving for a home, planning a family vacation, or setting aside funds for your children’s education. It transforms vague hopes into actionable plans, providing a clear roadmap to achieving your family’s aspirations.

Adapting to Life’s Changes

Life is full of surprises, and for families, flexibility is vital. Budgeting allows mums to navigate unexpected expenses confidently—a sudden repair, healthcare costs, or a change in income. With a plan, families can adjust their spending and saving strategies to accommodate these changes, minimising stress and uncertainty.

Fostering Financial Responsibility

By involving the whole family in the budgeting process, mums can instill financial responsibility values. Starting money literacy at an early age equips children with a clear understanding of the importance of saving, distinguishing between wants and needs, and recognising hard-earned money’s value, preparing them to make wise financial decisions.

Understanding the 50-30-20 Rule: A Busy Mum’s Guide to Budgeting

For busy mums navigating the complexities of managing household finances, the 50-30-20 rule emerges as a beacon of simplicity in the chaos of daily life. The rule can help you save and promises to streamline your financial planning. Ensure that every penny is allocated purposefully, fostering a balanced and sustainable economic environment for you and your family.

What is the 50-30-20 rule?

The essence of the 50-30-20 rule is to divide your monthly income into three primary categories: Needs, Wants, and Savings. Here’s how it breaks down:

- 50% Needs: This half of your income is dedicated to the absolute essentials—those expenses you cannot avoid. Think of housing, utilities, groceries, and health insurance. For a mum, ensuring the family’s needs are met is always the priority, and this segment acknowledges that fundamental truth.

- 30% Wants: This portion allows a little breathing room in your budget. It covers everything that makes life enjoyable but isn’t strictly necessary. Whether a family outing, an exercise class to destress, or a subscription service that keeps the kids entertained, it encourages a balanced lifestyle without compromising financial health.

- 20% Savings or Debt Repayment: The final slice of your budget pie is dedicated to building a brighter future. By setting aside 20% of your income for savings, investments, or debt repayment, you’re not just managing your money—you’re ensuring your family’s security and financial freedom.

Read more about the 50-30-20 rule to understand budgeting and saving better. Implementing the 50-30-20 rule is more than just a budgeting strategy; it’s a step towards achieving financial balance and peace of mind.

Why A Budget Planner?

A budget planner is crucial for anyone looking to improve their budgets. It allows for a clear view of monthly income, expenses, and spending habits, making it easier to identify areas for improvement.

Whether you’re saving for college, planning for health insurance, or simply aiming for financial independence, a detailed budget planner is your first step towards success. I have always been a fan of the Erin Condren budget planner and customizable budgets on Google Sheets. I love being able to keep an eye on my personal budgets.

What Makes My Planner Stand Out?

Our best weekly budget planner is not just about numbers; it’s designed to inspire and motivate. Each page encourages reflection on daily gratitude, fostering a positive mindset towards money management. With dedicated sections for goal setting and debt tracking, it offers a holistic approach to financial planning.

Features That Shine

- Customisable Budgets: Tailor your budgeting tool to meet your financial needs, whether you’re focusing on savings accounts or expense categories.

- Habit Tracker: Monitor your progress and stay on track with your financial goals.

- Inspirational Quotes: Daily doses of motivation to keep you inspired on your journey to financial freedom.

Comparing Tools

While our planner is a standalone masterpiece, it complements well with other financial tools. From the Clever Fox Budget Planner to Erin Condren’s Budget Planner, exploring different budgeting apps and financial products is essential to find what best suits your lifestyle. CNBC Select and Pocket Guard are great resources for pre-qualified offers and positive reviews on various financial planning tools.

A Tool for Every Mum

Whether you prefer a budget book’s tactile feel or a mobile app’s convenience, our planner is adaptable. It’s a perfect fit for managing business expenses, planning a family budget, or even as a college student looking to get a head start on financial planning.

Inside the FREE 2024 SUCCESS PLANNER: A Roadmap to Your Best Year Yet

Dive into the pages of our FREE 2024 SUCCESS PLANNER, meticulously designed to guide busy individuals and families towards achieving their dreams with clarity and purpose. Here’s what makes it an indispensable asset:

Tips to Achieving Success

Actionable tips to achieving success that set the tone for a productive year. These insights are curated to inspire and motivate, laying the foundation for a mindset geared towards attaining greatness.

Year at a Glance & Week at a Glance

With the Year at a Glance and Week at a Glance page, you can see your commitments and opportunities. This overview ensures you stay on top of important dates, enabling efficient planning and time management.

Annual Goals & SMART Goal Plan

Define your aspirations with the Annual Goals section and refine them using the SMART Goal Plan. This framework encourages you to set Specific, Measurable, Achievable, Relevant, and Time-bound goals, ensuring your ambitions are clear and attainable.

Monthly Goal Plan & Goals and Reflections

The Monthly Goal Plan, alongside Goals and Reflections pages, allow for a deep dive into monthly objectives, offering space to reflect on achievements and lessons learned, fostering a cycle of continuous improvement.

Weekly Planner & Daily Planner

Stay organised with detailed Weekly and Daily Planners. These layouts provide ample space for scheduling tasks, appointments, and personal time, ensuring every day is aligned with your overarching goals.

Day on One Page & Daily Expense Tracker

Experience the power of focused planning with Day on One Page, complemented by a Daily Expense Tracker. This combination empowers you to manage your time and finances precisely, keeping your schedule and budget in check.

Monthly Expenses & Income Tracker

The Monthly Expenses Tracker and Monthly Income Tracker offer a comprehensive view of your financial health, enabling you to monitor cash flow and adjust spending habits for optimal economic growth.

Month on One Page & Habit Tracker

Month on One Page provides a quick snapshot of the month’s key activities. The Habit Tracker helps you cultivate positive habits that contribute to your success, ensuring consistent progress towards your goals.

Daily Gratitude & Reflection Journal

Embrace positivity with Daily Gratitude entries and reflective moments in the Reflection Journal. These sections are designed to foster a mindset of appreciation and self-growth, which are vital components of a successful life.

Vision Board & Motivational Quotes

Visualise your dreams with a personalised Vision Board and stay inspired with a collection of Motivational Quotes peppered throughout the planner. These elements serve as daily reminders of your purpose and potential.

My FREE 2024 SUCCESS PLANNER is a blueprint for personal and professional triumph. With its carefully crafted sections, it’s designed to guide you through setting and smashing your goals, reflecting on your journey, and celebrating your successes. Embrace this tool, and let it propel you towards a year of unparalleled achievements.

Navigating Your Finances with the Right Tools

Choosing the right tools can make all the difference in the quest for financial stability and growth. For mums and families aiming to streamline their finances, understanding and utilising resources like the best budget planners, monthly budget planner, bank accounts, and modern technology aids such as budget spreadsheets and best budgeting apps are crucial steps. Here’s how each component plays a pivotal role in managing your family’s cash flow effectively:

Best Budget Planners

A comprehensive best budgeting planners offer a structured way to oversee your finances, enabling you to allocate funds efficiently toward various needs and goals. Whether you’re drawn to traditional paper or digital versions, the best budget planners incorporate expense tracking, goal setting, and savings strategies designed to accommodate your unique financial situation.

Monthly Budget Planner

Utilising a monthly budget planner encourages regular review and adjustment of your financial plan, helping you control your money. Ensuring that your spending habits and savings goals align with your monthly income. This regular check-in is invaluable for staying on track towards achieving financial objectives and adapting to changes in your financial landscape.

Bank Accounts and Credit Score

Your choice of bank accounts and understanding of your credit score are foundational elements of personal finance management. Selecting the correct bank accounts for checking, savings, and investments affects your ability to manage your cash flow and save effectively. Simultaneously, a healthy credit score opens doors to better terms on credit cards and loans, impacting your financial flexibility and the cost of borrowing.

Budget Spreadsheet and Credit Cards

A budget spreadsheet can be a highly customisable tool for those who prefer a more hands-on approach. It offers insights into your financial health and helps you plan for both short-term expenses and long-term goals. Wisely using credit cards not only aids in managing cash flow but can also improve your credit score when used responsibly.

Before You Go

The FREE best weekly budget planner: Budgeting Busy Mums 2024 is more than just a planner; it’s a commitment to control your money and your life. With customisable budgets, inspirational quotes, and great tracking, it’s designed to support you at every step of your financial journey. Download your free version today and start transforming your financial future. Keep your eyes peeled, for my free budget templates are coming soon. I’m so excited to share them with you.

This is a collaborative article.